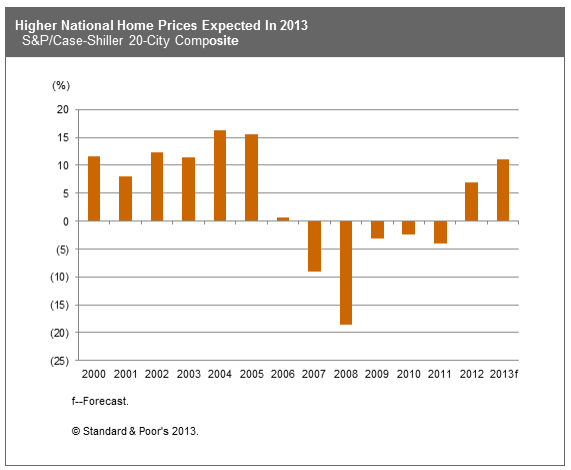

Today on HousingWire, Christina Mlyinski reports that “California home prices increased by the most in 33 years as a result of strong sales growth in higher-priced markets and continued housing supply shortage, pushing up median home prices in May.” It’s lead to whispers about another housing bubble, but as Megan Hopkins writes, not so fast. “Standard & Poor’s Ratings Services states that, although double-digit gains are ultimately unsustainable, we may not have reached bubble status quite yet.”

“Home price appreciation can be attributed to a number of factors, including historically low rates, property purchases by investors who are renting homes out and a shortage in home inventory… S&P states that U.S. home prices are relatively low compared to historical values… Additionally, housing remains undervalued about 8% based on the price-to-income ratio, which takes into account the median sales price of a home relative to median annual incomes…”

“Overall, S&P expects that the current pace of home prices gains will not last for long; however, it’s too soon to call this a bubble. In fact, as home values are still below their pre-recession peaks, home prices could continue to rise throughout the year.”

For help selling or buying your home in this active market, contact the people who have a successful track record and a long list of satisfied clients: the friendly, local professionals at Tracy Do Real Estate.

To receive new listings by email, or to schedule a viewing click here!